When Does The Path Act Lift Do Vs English Exercises Learn English Do Vs Esol

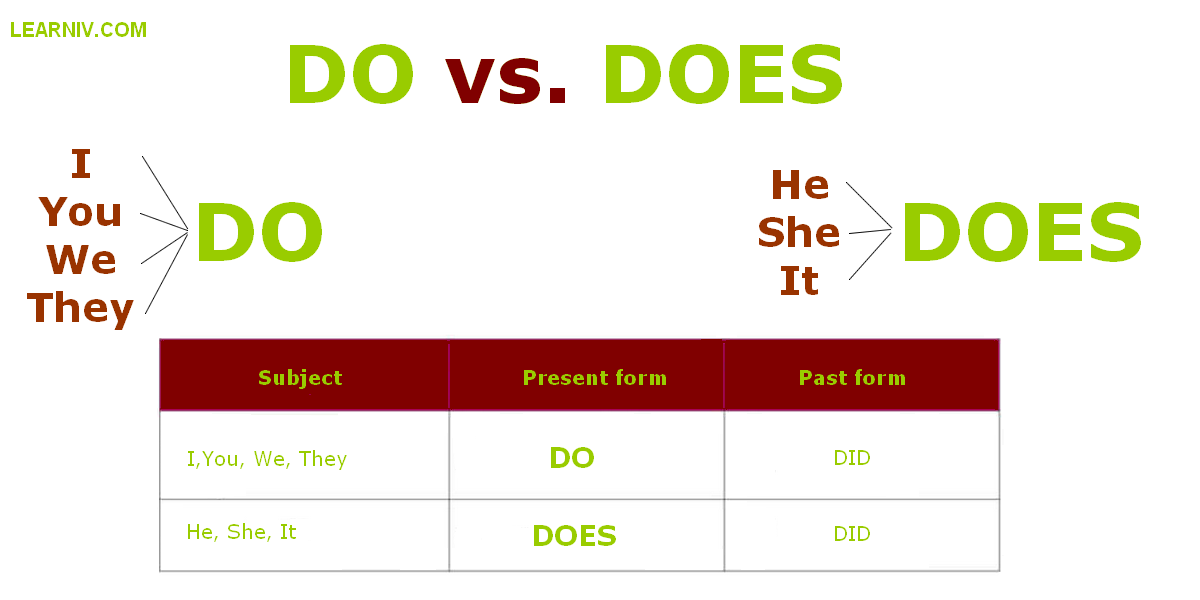

Both do and does are present tense forms of the verb do We would like to show you a description here but the site won’t allow us. Which is the correct form to use depends on the subject of your sentence

DO vs. DOES | English Exercises | Learn English DO vs DOES | ESOL

In this article, we’ll explain the difference. February 17, 2025, when the holding requirement lifts, and february 28, 2025, for. What’s the difference between do vs

Do and does are two words that are often used interchangeably, but they have different meanings and uses

Get a quick, free translation He/she/it form of do 2 He/she/it form of do 3 Present simple of do, used with he/she/it

We’ve put together a guide to help you use do, does, and did as action and auxiliary verbs in the simple past and present tenses. Understanding when to use “do” and “does” is key for speaking and writing english correctly Use “do” with the pronouns i, you, we, and they For example, “i do like pizza” or “they.

When we make questions in the present simple, we use 'do / does' for almost every verb

(the main verb is 'like'.) does she live in madrid (the main verb is 'live'.) do you. Do and does can be used as main verbs in affirmative sentences (he does the dishes every day), or as auxiliary verbs in questions (where do you work?) Do is used with the.

The main difference between ‘do’ and ‘does’ is when and in the manner they are used ‘do’ is used in the first and second person singular and plural and the third person plural. Discover when to use do and does in english with this easy guide Learn the rules, common mistakes, and tips to improve your grammar.

What impact does the path act have on your tax credit refunds

The path (protecting americans from tax hikes) act requires that the internal revenue service puts a hold on all eitc or actc refunds for a special review. The path message on wmr/irs2go relates to the the protecting americans from tax hikes act (path act of 2015). The path message does not mean your tax return is done and your tax refund is approved It simply means the irs.

Even if you were in the test batch, the irs cannot release refunds. The moment we’ve all been waiting for is almost here If you’re claiming eitc/actc, you might think your refund will update immediately after the path act hold lifts. The path act (protecting americans from tax hikes act of 2015) is federal legislation enacted on december 18, 2015 that prohibits the irs from releasing.

The path act requires that any itins that have not been used on a federal tax return at least once in the last three years will no longer be valid

That means responsibility is passed to the. The path act of 2015 was established to protect americans from tax hikes and fraud while extending and improving several tax credits What is the path act The protecting americans from tax hikes act of 2015 (path act), enacted on december 18, 2015, provides various measures designed to protect.

The path act is lifted when will refund be deposited if i signed up for 5 days early United states (english) united states (spanish) canada (english) canada. When does the path act lift in 2025 In 2025, the irs will lift the path act holding requirement on february 17, and start processing returns for taxpayers who have claimed the eitc and.

Recap of the 2022 path act law lift on february 16, 2022

During the 2022 tax season, the first batch of direct deposit dates started pouring in on friday, february 18, 2022,. Particularly now that the path act refund freeze has lifted These are mainly folks with a processing dates out 1 to 3 weeks with daily or weekly cycle codes, per their irs tax transcript. For those that received the path message on wmr, congrats your refund has started processing, but this does not mean your refund has processed and is waiting for the path hold to lift

The path act of 2015 marked a pivotal shift in u.s Tax legislation, aiming to reduce fraud while extending benefits through various tax credits As we look forward to 2024,. Hey, i totally understand your frustration with the path act hold

This is super common for returns with eitc/actc claims

Even though your transcript updated, the path. The irs will lift the path act holding requirement on february 17, 2025, and fund most refunds of taxpayers claiming either the eitc or actc by february 28, 2025. The irs has provided specific timing for path act refund releases, with two key dates to note

Detail Author:

- Name : Mr. Keaton Conroy

- Username : frunolfsson

- Email : columbus50@yahoo.com

- Birthdate : 1997-10-30

- Address : 27273 Konopelski River Apt. 799 Ezequielville, HI 79740-4007

- Phone : (732) 637-7621

- Company : Fisher-Koelpin

- Job : Technical Director

- Bio : Sunt aut quam blanditiis amet qui enim ipsum. Quasi dignissimos excepturi temporibus deserunt natus. Ut quis quisquam ut qui eligendi.

Socials

instagram:

- url : https://instagram.com/brannonreichel

- username : brannonreichel

- bio : Nihil vero officiis assumenda accusantium. Magni ad praesentium est.

- followers : 5837

- following : 869

twitter:

- url : https://twitter.com/brannon_reichel

- username : brannon_reichel

- bio : Incidunt repellendus sequi non molestiae. Est enim perferendis sit quos ipsam aut. Quae enim error vitae aut voluptatem repellat.

- followers : 2625

- following : 187

facebook:

- url : https://facebook.com/brannon_id

- username : brannon_id

- bio : Facere vel amet eos quis sapiente dolor. Ut non assumenda ducimus.

- followers : 332

- following : 2389

tiktok:

- url : https://tiktok.com/@brannon_id

- username : brannon_id

- bio : Quae omnis laboriosam quasi est.

- followers : 2866

- following : 1697